Important Things to Do For E-invoice Users

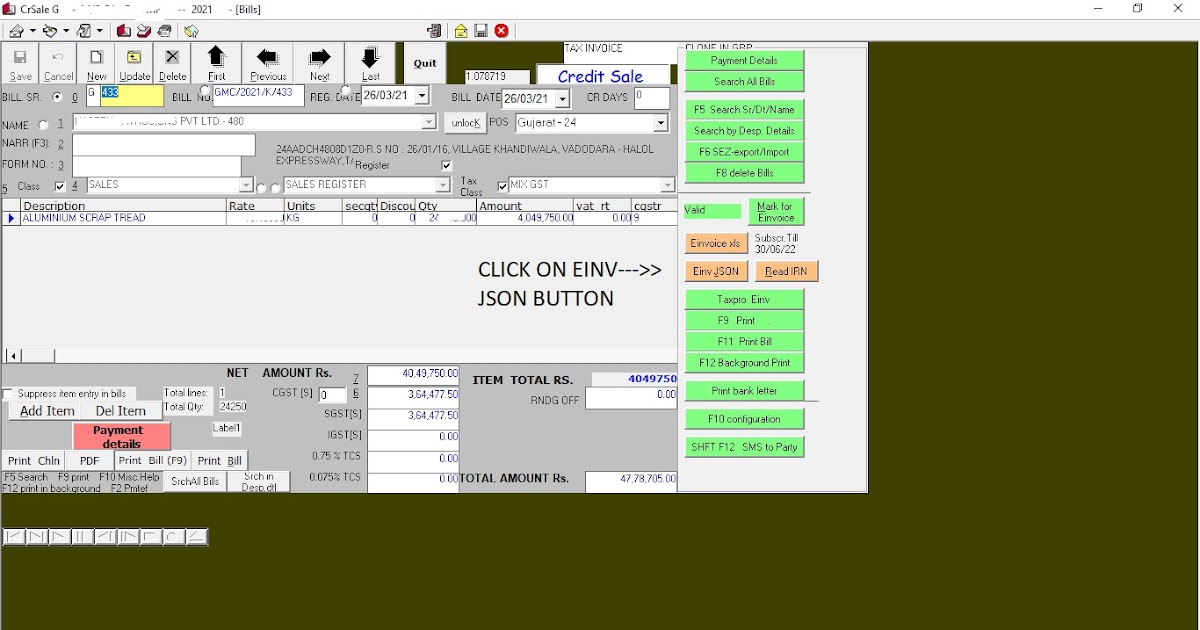

Invoice portal keeps invoices of only 3 days. If by any chance if you forgot to download xlsx file and read the IRN,Ackno,Ackdt etc. It will be difficult to get them.

If you download xlsx for each bill then each file is of 4kb and if saved individually it will use a lot of harddisk space. To save diskspace at the end of day open the portal and generate a report of generated e-invoice IrnGenByme.xlsx save this by adding the date e.g. IrnGenByMe05-04-21.xlsx

When you upload JSON containing GSTIN of canceled GSTIN and composition GSTIN , you will get a failed Invoice xlsx. Read this file and verify the numbers on gst.gov.in . Marking of composition dealer is given on Account Master beside GSTIN no. So mark it so that e-invoice will not be generated. If a party

E-Invoice videos of IRP

PINCODE TO PINCODE DISTANCE if kept 0 in EwayBill it will take as per their record

To do in Vfas

Please check your turnover . Inclusive of CGST+SGST +IGST if it is more than the limit prescribed by the GST council you have to compulsorily prepare e-invoice for all the B2B sale bills. For B2C a dynamic QRCODE showing your bank account or UPI id details alongwith total bill amount so that customer can pay by online or mobile transaction. Those customers printing their bills on high size stationery will have to change to full size paper so that QRCODE can be printed on bill.

Legal name of customer it may be different from trade name

Pincode of customer and distance so that it will be helpful in ewaybill.

Place select city code ( it should not be A/c.)

Phone no accepts only first 12 characters(numeric)

A report can be prepared from trial balance report having Legal name, Tradename,pincode ,Place

In items HSN, Unit of Quantity must match the options given if 15kgs is entered Vfas will take KGS

Enter self legalname and place pincode , ifsc,bank ac no from 6.tools firm details

open bills F10 setting do not round off tax ammount calculated by /

Put round off in S6